tax break refund tracker

The IRS says it updates payment statuses once. Check your tax refund status on the IRS website.

Why Do I Have The Path Message On Irs Where S My Refund

Solution found By logging in you can check under View Tax Records then Get Transcript.

. WHILE there are 436000 returns are still stuck in the IRS system Americans are looking for ways to track their unemployment tax refund. How To Track Unemployment Tax Break Refund. File your return electronically.

Go to the IRS Wheres My Refund tool and enter this info. An immediate way to see if the IRS processed your refund is by viewing your tax records online. Exact refund amount shown on your return.

Exact refund amount shown on. The refunds are being sent out in batchesstarting with the simplest. Wheres my state refund.

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. Tool to check your refund status on your smartphone tablet or computer. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

Once you e-file your return or drop it in the mailbox you can check in with the IRS for refund updates. Ad See How Long It Could Take Your 2021 Tax Refund. So far the refunds have averaged more than 1600.

You can call the IRS to check on the status of your refund. Choose the federal tax option and 2020 Account Transcript. Up to 10 cash back Are you wondering where is my refund.

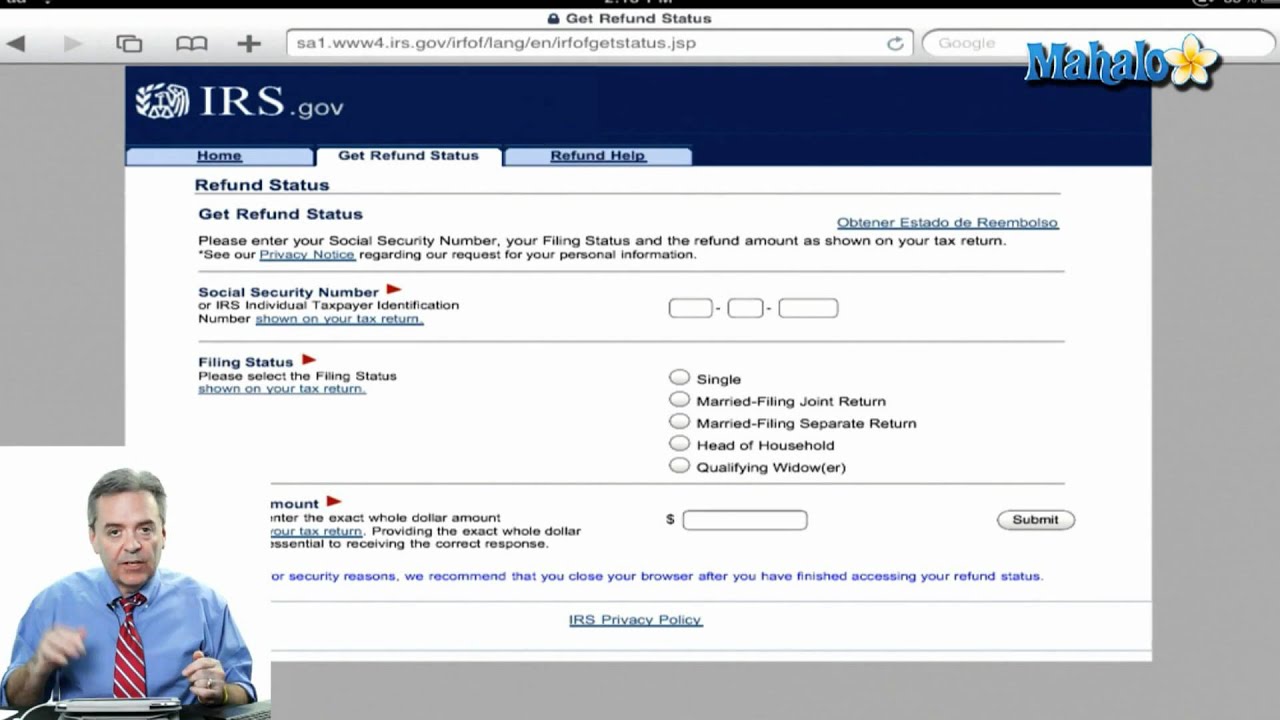

The systems are updated once every 24 hours. You will need your Social security number or ITIN your filing status and your exact refund amount. Return Received Notice within 24 48 hours after e-file.

This is the fastest and easiest way to track your refund. 22 2022 Published 742 am. Ad Easy and Efficiently Track and Manage all your Tax Filings and Projects in your Office.

Social Security Number or ITIN. Up to 10 cash back Use the IRS Wheres My Refund tool to find out when you can expect your refund to arrive. Another way is to check your tax transcript if you have an online account with the IRS.

Track your IRS tax refund status. You will be directed to the IRS Web site and need the following information. You can call the IRS to check on the status of your refund.

Use our tax tools to help navigate through the IRSs website to track your refund. Ad See How Long It Could Take Your 2021 Tax Refund. One of the lesser-known provisions of the 19 trillion American Rescue Plan was a substantial tax break for recipients of unemployment benefits.

However IRS live phone assistance is extremely limited at this time. Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online. You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your unemployment tax refund.

Tax Refund Processing. How to track your tax refund. Couldnt find your refund with our tool or you filed a paper copy of your tax return.

Ad Learn How to Track Your Federal Tax Refund and Find The Status of Your Paper Check. 1 day agoAccording to the release payments will be issued based on an individuals 2021 income tax return with an income cap of 100000 for individual filers and 150000 for joint filers. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

Start checking status 24 48 hours after e-file. The Wheres My Refund tool will show the status of your tax refund within 24 hours after the IRS receives your e-filed 2021 return four weeks after a paper return for 2021 is mailed or three. Learn How Long It Could Take Your 2021 Tax Refund.

An amended return can take up to three weeks to show up in the IRS system after you send it. Find out how to check the status of your tax refund in your state. Check For the Latest Updates and Resources Throughout The Tax Season.

In the latest batch of refunds announced in November however the average was 1189. Solution found How To Track Unemployment Tax Break Refund. Youre sacrificing time if youre sending your return in the mail.

Visit IRSgov and log in to your account. TurboTax After You File Track Your Refund. Then check for entries labeled Refund issued.

Online portal allows you to track your IRS refund. Check your federal tax refund status. Those who file an amended return should check out the Wheres My Amended Return.

Make sure you never miss another filing date and help your firm run smoothly. On the IRSs website you can use its Wheres My Refund. Well help you track your tax refund After the IRS accepts your return it typically takes about 21 days to get your refund.

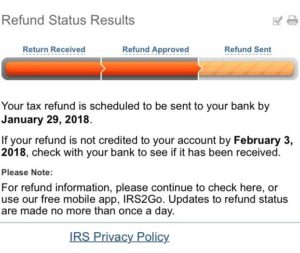

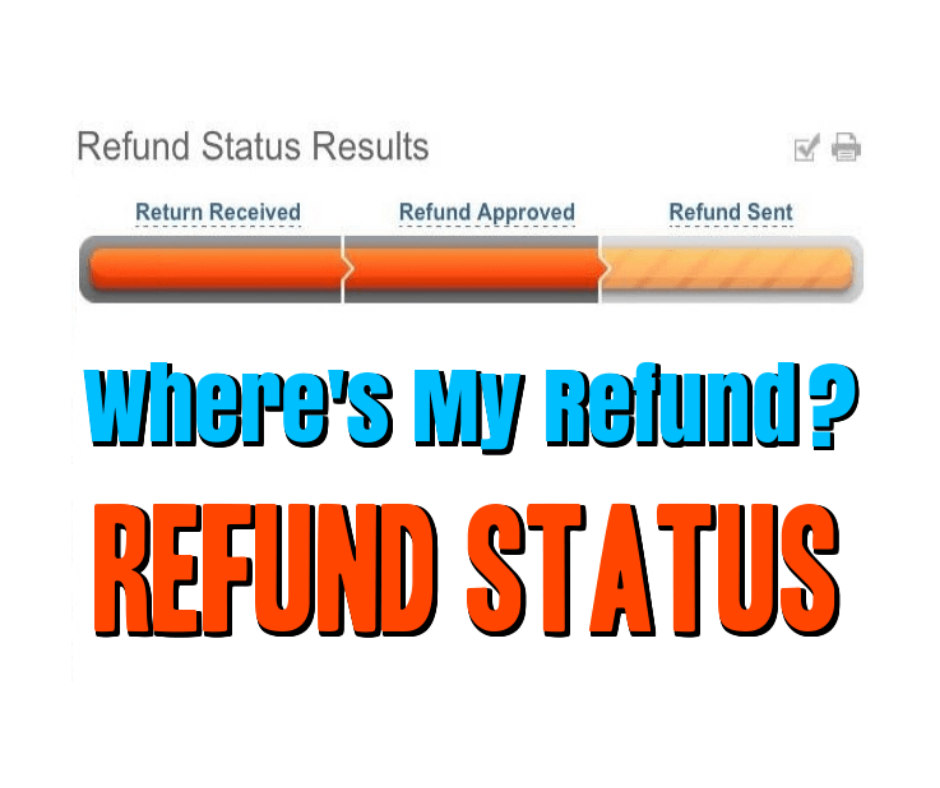

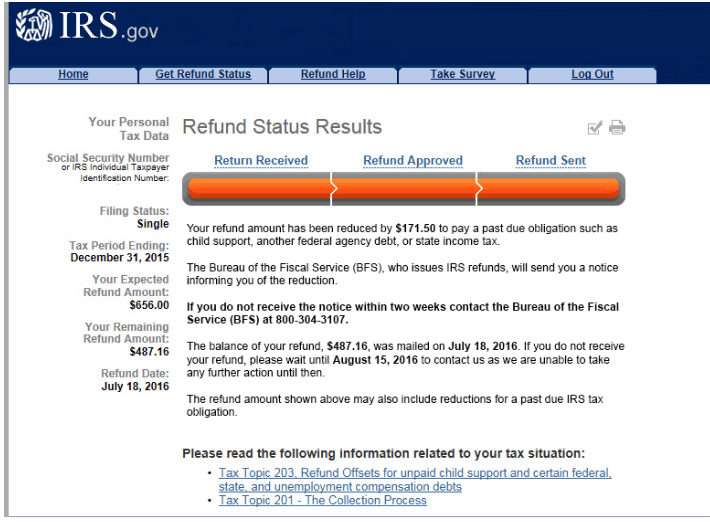

Return Received Refund Approved Refund Sent You get personalized refund information based on the processing of your tax return. You can still track the refunds status through the IRS website if you file an amended return. It allows taxpayers to track their refund through three stages.

The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income. This is available under View Tax Records then click the Get Transcript button and choose the. Generally the IRS issues most refunds in less than 21 days but some may take longer.

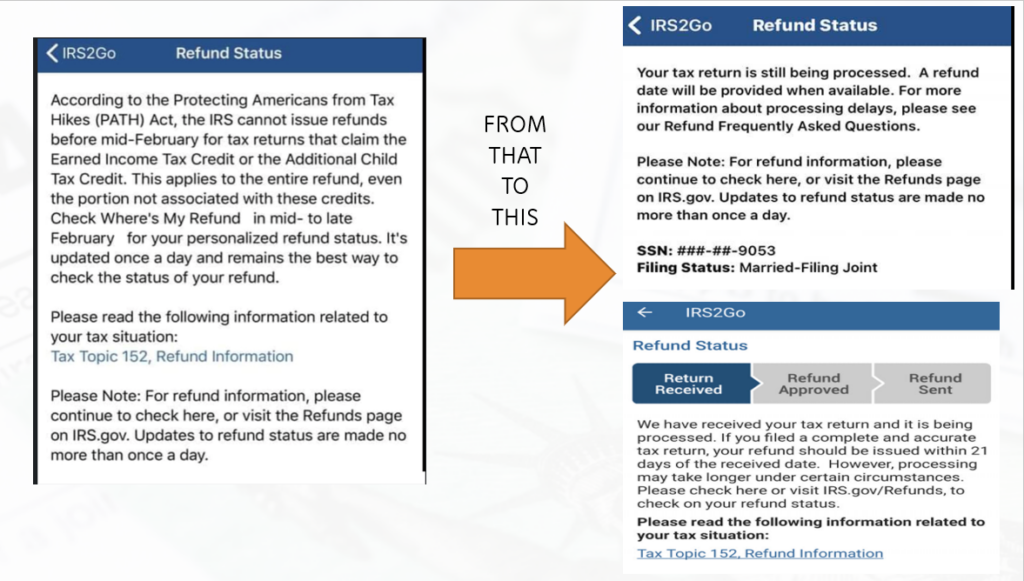

Skip quiz Retake Quiz. Lets track your tax refund. How to use IRS2Go to track your tax refund The IRS also has a mobile app called IRS2Go available for both iOS and Android which checks your tax refund status.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. Once you have e-filed your tax return you can check your status using the IRS Wheres My Refund. Click on the button to go right to the IRSs refund tracker for federal tax refunds.

Taxpayers on the go can track their return and refund status on their mobile devices using the free IRS2Go app. You can still check the status of your federal income tax refund. Heres how to check your tax transcript online.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. E-filing allows you to check the status of your refund within 24 hours and at least gives you a chance to see the money within the 21-day window. Just plug in your Social Security number date of birth and ZIP code.

You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

American Tax Services Where S My Refund The Irs Issues Most Refunds In Less Than 21 Days Although Some Require Additional Time Check The Status Of Your Refund Online Here Https Sa Www4 Irs Gov Irfof Lang En Irfofgetstatus Jsp Check

Tax Refund Status Is Still Being Processed

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

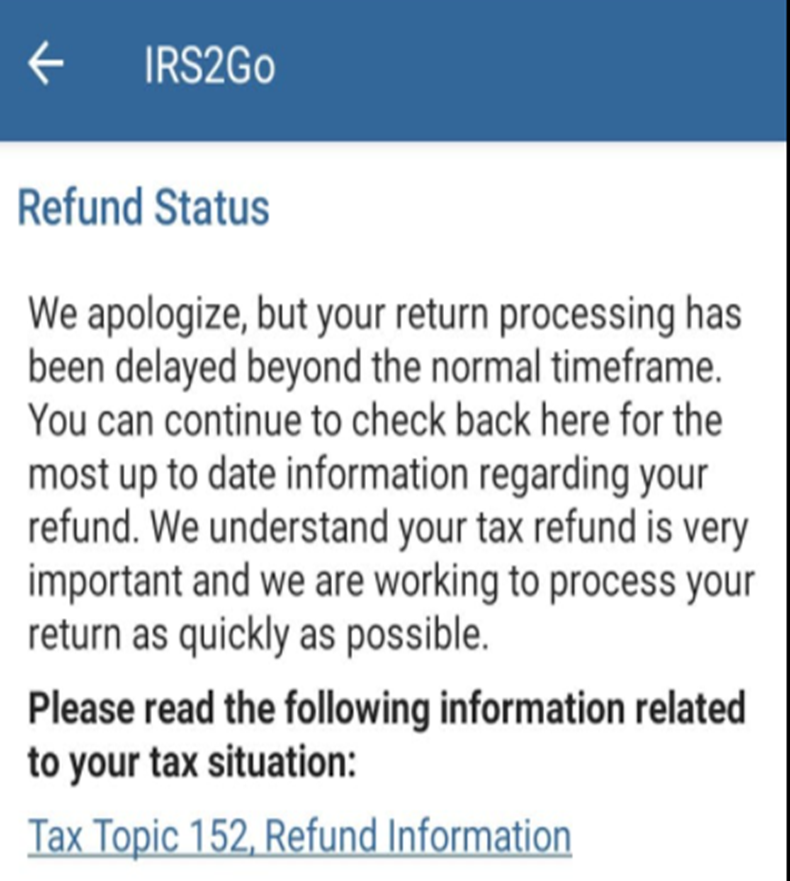

Refund Status We Apologize Return Processing Has Been Delayed Beyond The Normal Timeframe Wmr Tax Topic 152 Or Code 570 971 On Irs Transcript Aving To Invest

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Where S My Refund How To Track Your Tax Refund 2022 Money

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Refund Tracker Why Is Your Tax Return Still Being Processed Marca

Is It Possible To Check My Refund Status Online If I Don T Know The Amount Youtube

Refund Status Where S My Refund Tax News Information

Irs Where S My Refund Bars Disappeared 2020 Youtube

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

When Will I Get My Irs Tax Refund Latest Payment Updates And 2022 Tax Season Statistics Aving To Invest

Refund Status Where S My Refund Tax News Information